First time home buyer poor credit score

Ad Dont Let Bad Credit Score Stop You. FHA allows a home buyer to make a down payment of 35 and a seller contribution of up to 6 for closing costs with only a 580 minimum credit score.

What Is A Credit Score Bayou Mortgage

Santa Anas Downpayment Assistance Loan Program provides eligible applicants up to 40000 to be put toward the down payment on their new home.

. Ad Increase your Credit Scores Get Credit for the Bills Youre Already Paying. The good news is. Now if you are applying for a home loan then you need an average credit score for first-time home buyer of at least 640 particularly for first-time home buyers assistance.

Im Wondering How It Works. Generally 620 is the. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality.

Apply Get Pre Approved in 3 Minutes. Los Angeles first-time home buyers. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

FHA allows you to make a down payment of only 10 if you have credit scores below 580. Free Credit Monitoring and Alerts Included. First Time Home Buyer Poor Credit Loans - If you are looking for lower monthly payments then our convenient service is a great way to do that.

Special Offers Just a Click Away. Buying a home is as much about your state of mind as the state of your bank accountbut both need to. Ad Compare Top Mortgage Lenders 2022.

4 Habits of Successful Home BuyersGet Yourself Ready to Buy. Bank of America has also made a separate 15 billion commitment to provide mortgages to low- to moderate-income homebuyers through the Neighborhood Assistance. The median home listing price in Los Angeles was 1019000 in April 2022 according to Redfin.

Many first-time home buyers worry that their credit scores are too low to buy a home. Find The Home You Deserve. First Time Home Buyer Poor Credit Loans.

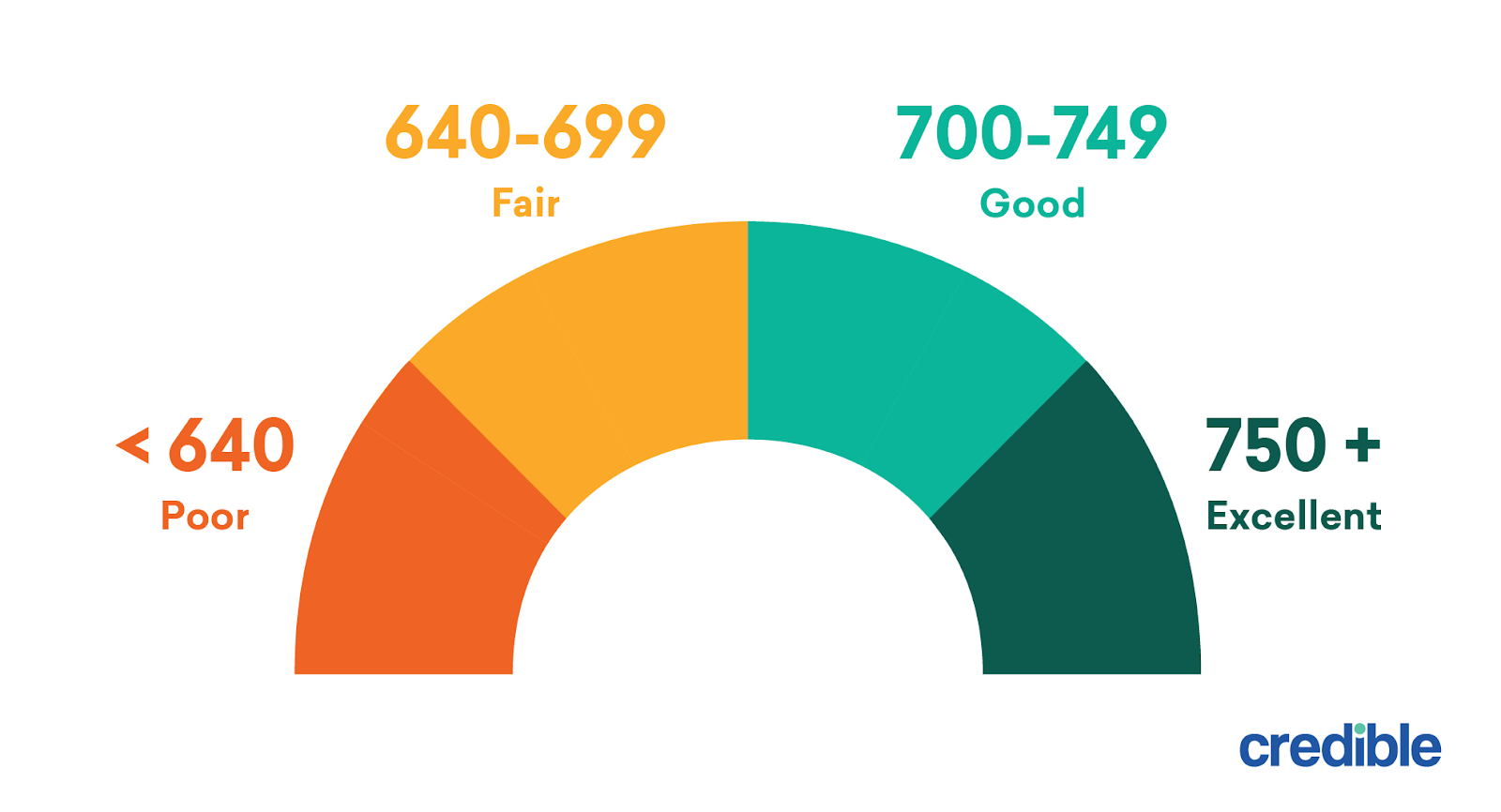

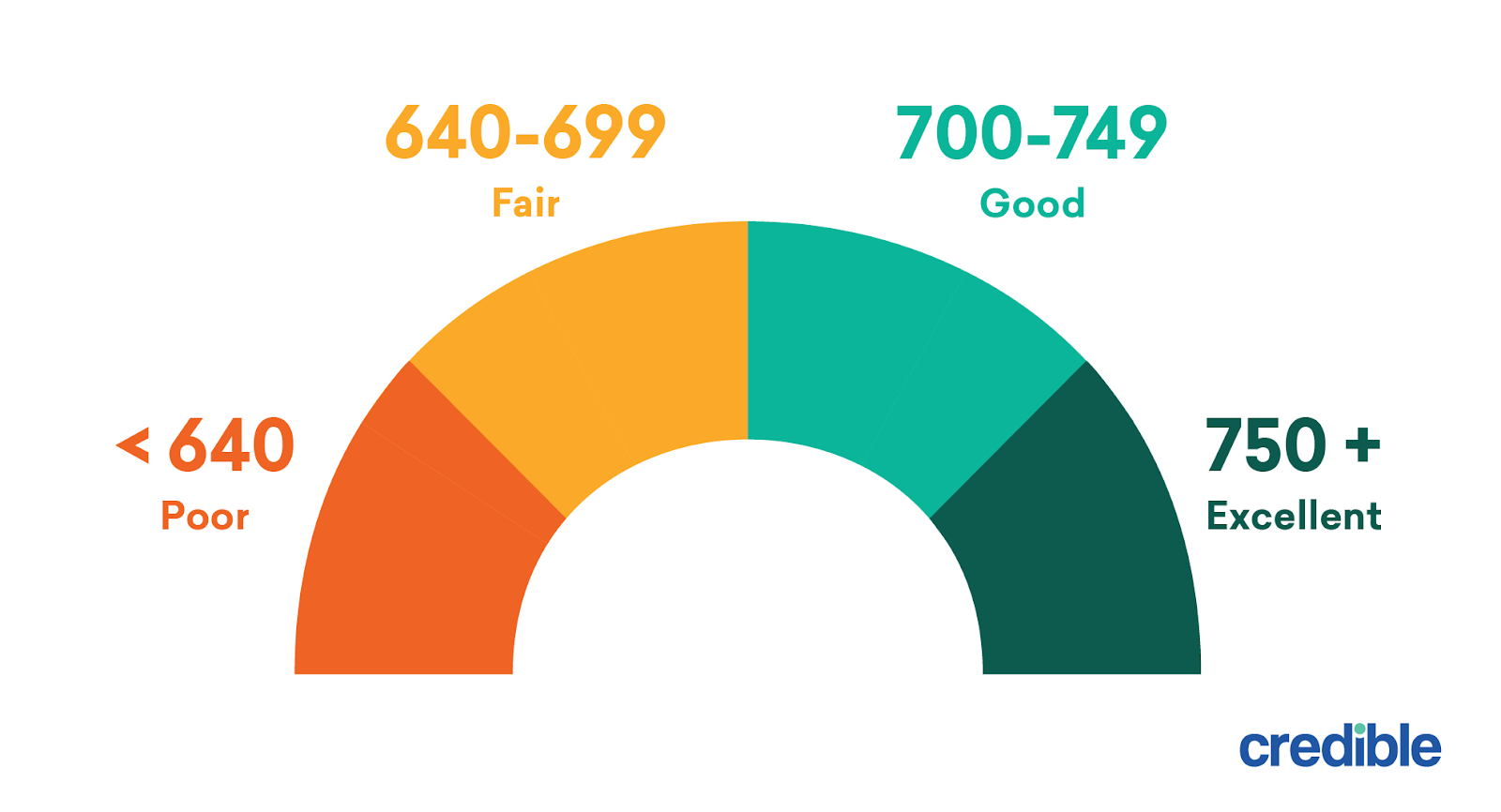

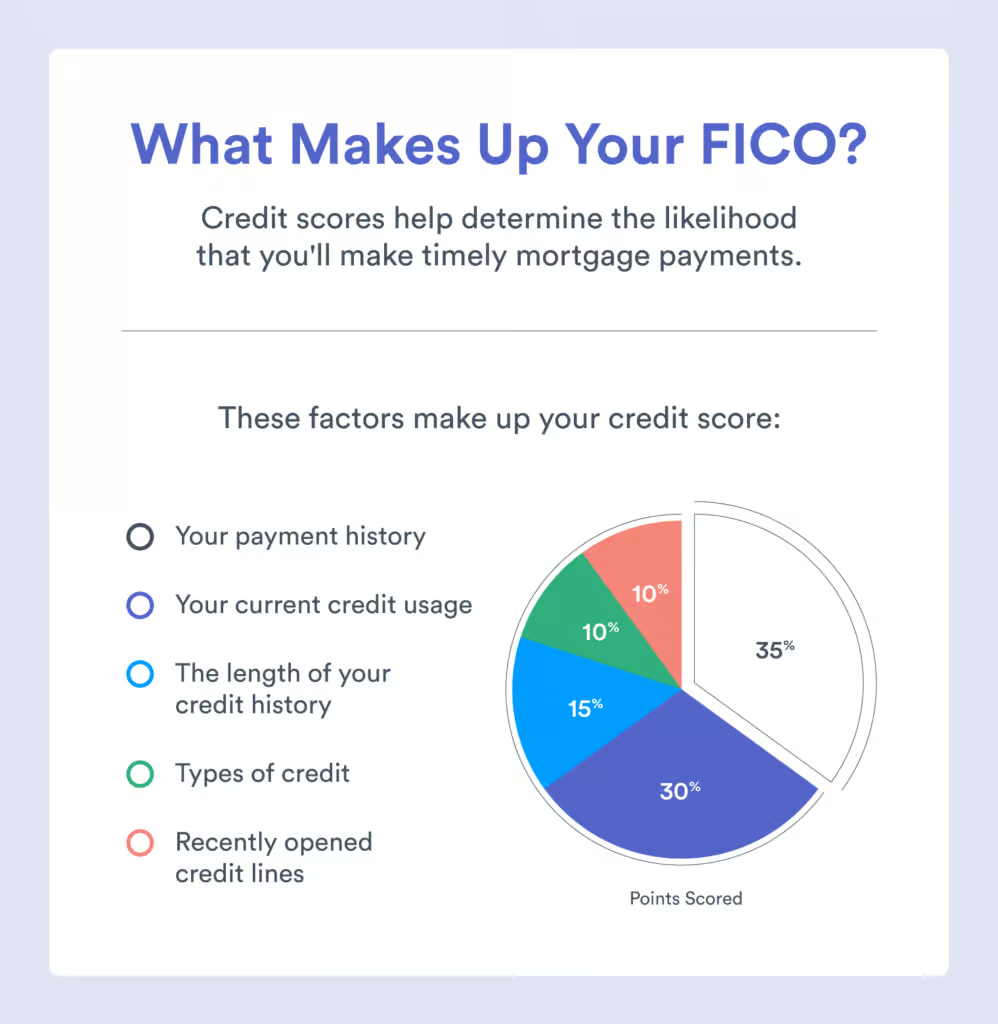

Because a credit score of 500 is required to get mortgage-approved only 5 of US. A credit score which can in theory range from 300 to 850 of around 640 is usually sufficient to meet minimum credit score requirements for first-time home buyer assistance but this varies. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality.

In late 2021 FICO reported borrowing rates ranging from 2576 for homebuyers with credit scores of 760 and above to 4165 for those with credit scores 620-639. These funds are available on a first. Types of Bad Credit Mortgage Options For Home Buyers.

Ad Rental Homes Available Near You. If you only have cash on hand that can pay for 35 of your homes purchase price then a minimum credit score of 580 will be good enough for an FHA loan. Whether a new home is a few years off or youre shopping now we can help you understand your options and get the right mortgage for your situation.

Compare Offers From Our Partners To Find One For You. In 2022 those limits are 420680 and. Ad View your latest Credit Scores from All 3 Bureaus in 60 seconds.

Take the First Step Towards Your Dream Home See If You Qualify. First time buyers need a minimum credit score of 500 for an FHA loan approval. That was up by 125 year-over.

Consumers would be mortgage-ineligible based on their credit score alone. HUD offers a 35 down payment for borrowers with at least a 580 FICO Score. Ad Compare for the Lowest Home Loan Rate that Suits Your Needs.

2022 FIRST-TIME HOME BUYER DOWN-PAYMENT ASSISTANCE FUNDS ARE GENERALLY FIRST COME-FIRST SERVED AND ARE NOT GUARANTEED. First know that whether your credit score is good or bad is subjective and wont. First-time homebuyers On Down Payment Varies Dependent On The Loan Program.

Take Advantage Of Low Rates. Ad First Time Home Buyers. In addition to expanding access to credit and down payment assistance Bank of America provides educational resources to help homebuyers navigate the homebuying.

We Have Helped Many. Check Your Eligibility for a Low Down Payment FHA Loan. Borrowers can qualify for FHA.

Find Out How Much You Can Afford. Choose Smart Apply Easily. Ad First Time Mortgage Programs.

FHA loans are by far the most popular loan program for first-time homebuyers. Bank of America is offering zero down payment mortgages with no closing costs for first-time homebuyers in certain Black and Hispanic neighborhoods in a new program. New Credit Scores Take Effect Immediately.

The Best Mortgages for First Time Home Buyers with Bad Credit August 27 2022 Qualifying for a mortgage is difficult especially if you have a low credit score or no.

10 Cities Where A Poor Credit Score Isn T Stopping Home Buyers

How To Buy A House With 0 Down In 2022 First Time Buyer

How To Get A Bad Credit Home Loan Lendingtree

How To Get A Mortgage With Bad Credit Credit Com

640 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2022 Badcredit Org

What Credit Score Do You Need To Buy A House In 2022

How To Buy A House With Bad Credit Nerdwallet

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

How To Buy A House With Bad Credit A Guide For First Time Home Buyers

How To Buy A House With Bad Credit Fico Less Than 600 Debt Com

How To Get A Home Loan With Bad Credit In New York Propertynest

Buying A New Car When You Have Bad Credit Edmunds

What Credit Score Do You Need To Buy A House In 2022 Ally

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

How To Buy A House With Bad Credit Improve Your Credit Credit Org

Minimum Credit Scores For Fha Loans